How have people outperformed the market? The first installment in our series on historically well-performing strategies: leveraging.

This story is part of a series that analyzes investing strategies that have historically outperformed a specific index. Past results are no guarantee of future results, and this information is not to be construed as investment advice. Also, take your vitamins.

One of my favorite pastimes is backtesting investing strategies that would have made me a millionaire over the last five years and cry silently while eating an entire bucket of Haagen-Daaz.

Then I remind myself about Melvin Capital imploding over the GameStop short squeeze, or Bill Hwang blowing up Archegos Capital, and I feel slightly better.

What do I have in common with these elite Wall Street fund managers? A complete inability to outperform the market apparently. That, and an unhealthy tolerance for excessive risk-taking.

When people talk about the market, they usually refer to the S&P 500 index, a market capitalization-weighted index of the largest publicly traded US companies.

When we talk about beating the market, it’s in the context of risk-adjusted returns over a long period of time (10+ years).

I cannot emphasize the importance of “risk-adjusted” enough. Any Buffett wannabe can YOLO their 401(k) into a meme stock or crypto and “beat the market” in terms of absolute returns over a short period.

In those cases, you’re taking on excessive risk for a slim chance of high returns, and that level of risk-taking is not sustainable. Essentially, you’re gambling rather than making a risk-savvy long-term bet. To beat the market, you want to achieve either:

Some people, like Warren Buffet, beat the market through consistent smart stock picking. A few did it through insider trading, but I won’t name names. Others just got lucky, like these monkeys who picked random stocks to invest in by throwing darts.

It’s worth remembering that few stocks consistently outperform the S&P 500 in the long term. Look at the performance of Meta and Netflix recently, which used to be the top dogs. The best stocks in the S&P 500 back in the 1990s—IBM, General Motors, Ford—have all fallen from grace. While a handful of market-beating stocks outperform, the majority fail to beat Treasury bills.

Stock picking is extremely hard. I hate to break it to you, but nobody (short of Buffett, apparently) knows whether a stock will go up or down in the future.

Instead, normal retail investors (like you and I, the so-called “dumb money”) should resort to different stock market investing strategies for a chance at outperforming the market.

If you want to say it out loud, take a big breath first: The strategy is called Leverage up an efficient portfolio of uncorrelated volatile assets along the capital allocation line to your desired level of risk and return.

Total word salad. But the idea isn’t anything groundbreaking. It’s been around for quite some time, with a variant using leveraged ETFs achieving notoriety on the Bogleheads forum as Hedgefundie’s Excellent Adventure.

Here’s the breakdown.

In the aggregate, different investment asset classes come with varying degrees of correlation.

Stocks drop during market crashes, but Treasury bonds usually rise as interest rates drop and investors panic buy them (that’s what we call a flight to quality). Both stocks and bonds also generally trend upwards over time (a positive carry).

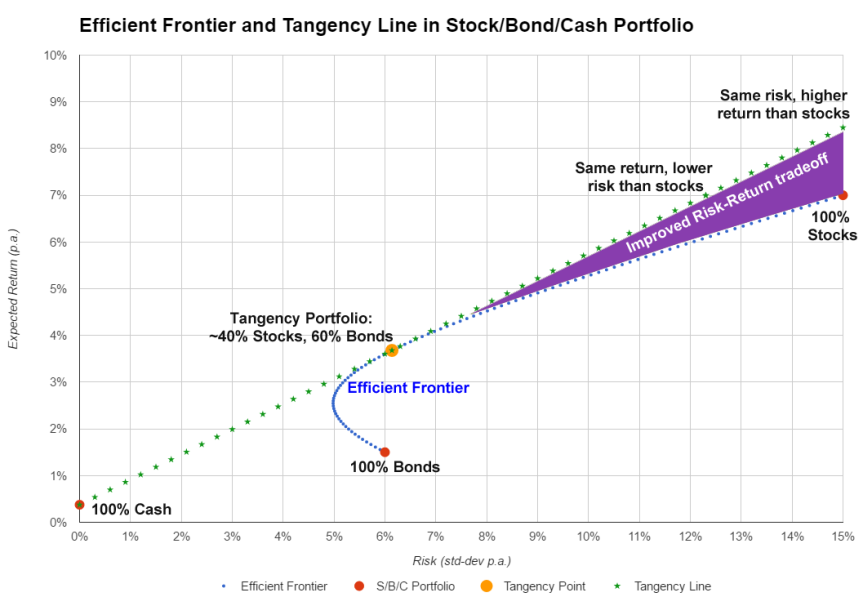

Logically, if both stocks and bonds generally go up and aren’t perfectly correlated, there could be a benefit in mixing them together in various allocations to reduce risk and improve returns. In other words, diversified portfolios are the best portfolios. Take a look at this graph. Risk, measured by standard deviation, is measured along the x-axis, while return is measured along the y-axis. You’ll find the risk and return profile of various portfolios plotted, including 100% cash, 100% bonds, 100% stocks, and 40/60 stocks and bonds.

The blue dotted curve represents possible variations of these portfolios. The efficient frontier is the range of portfolios producing higher returns for lower risk. The yellow dot represents the tangency portfolio, which is the one with the best risk-return profile (called the Sharpe ratio).

However, this portfolio still produces lower returns than 100% stocks. To beat the market, we have to apply leverage, which multiplies our returns and risk. The amount of leverage applied is represented by the green dotted line, called the capital allocation line.

Following the capital allocation line, we can scale up using our desired level of leverage 000 usually 1.5x to 2x—to give either our 40/60 stock and bonds portfolio the same return but lower risk, or higher returns but the same risk compared to 100% stocks.

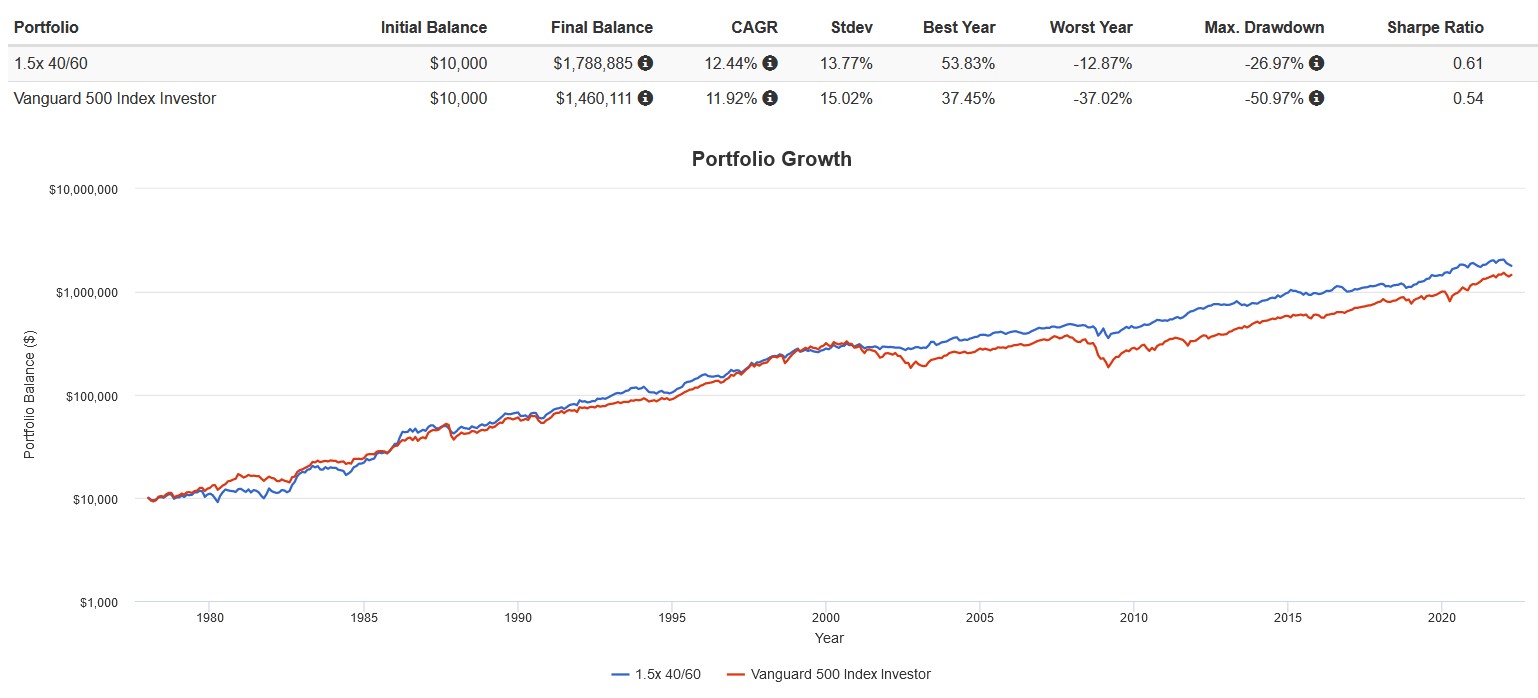

Here’s how this strategy would have worked out from 1977 to April 2022 based on a Portfolio Visualizer backtest. The portfolio is a 40/60 allocation of the total US stock market and long-term U.S. Treasurys, with 1.5x leverage applied at an annual 5% interest rate and quarterly rebalancing.

Note that this strategy comes out with:

The risk-return profile—shown by a Sharpe ratio of 0.61 vs 0.54—also improved. An investor who implemented this strategy and stayed the course would have beaten the market handsomely. The strategy also works well with a 50/50 or 60/40 allocation, depending on your thesis for Treasury returns moving forward.

Warning: This strategy isn’t foolproof, though. As with all things, past performance does not imply future performance. It relies heavily on the uncorrelation between stocks and bonds. In a time of rising interest rates and high inflation, this correlation can turn positive. Bonds also outperformed for the last few decades due to an era of falling interest rates, which lowered yields and boosted their returns.

Funny enough, this strategy is actually doing very poorly in 2022 thanks to this exact risk occurring (I know from personal experience—ouch).

I do not recommend this strategy to most investors. Not because it is complex (it’s not), but pulling off this strategy is a true test of your will. Most investors suffer from tracking-error regret: the feeling of doom once you realize your portfolio is not doing as well as the S&P 500. Over the short term, this will happen.

This strategy is down more than the S&P 500 so far in 2022, thanks to bonds falling along with stocks, amplified by the leverage. Investors are abandoning their plans at the bottom to flee into hot assets like the energy sector, commodities, REITs, gold, and value stocks.

If you also do not have the discipline to stay the course, weather high volatility, and trust in the theory and math, this strategy is not for you. It relies on a set of assumptions that have held true over the last few decades, but may not in the future as the investment environment changes. I mean, the dude who invented Modern Portfolio Theory back in the 1950s never envisioned a world where Gen Z investors YOLO’d their college funds on short-term call options.

For most investors, the most clear-cut, dependable, and simple way to succeed is to buy a low-cost, globally diversified stock index fund, paired with a bond fund depending on your risk tolerance and time horizon. Then, focus on maximizing your savings rate, consistently making contributions, and learning to stay the course during market dips.

Now, The Clash didn’t exactly sing that, but in an alternate universe where they managed a hedge fund, they might have.

Strategies like the one I described above require a good deal of cold-blooded rationality, conviction in the math underlying the theory, and an utter, zen-like detachment from market noise. If you’re absolutely set on trying it, ensure you do your own independent research, consult dissenting opinions, and risk only what you can afford to lose.