Choosing your tax withholding amount will dictate whether you receive a refund at the end of the year or have to pay more. Here’s how it works.

Choosing your tax withholding amount will dictate whether you receive a refund at the end of the year or have to pay more. Here’s how it works.

For many people, tax day is a day of surprises. Will I get a refund? Will I have to pay more? Did I forget to pay taxes for the last six years and now I’m going to prison? It doesn’t have to be that way.

Use the IRS Form W-4 to manage the amount your employer withholds from your paycheck each month. You can make sure you won’t owe more money at the end of the year. Here’s how it works.

There are typically two parts to tax withholding: FICA (Social Security and Medicare) and income taxes. FICA taxes are set rates (6.2% for Social Security and 1.45% for Medicare) so they can’t be manipulated. Withholding for federal and state income taxes can be changed, but that could come back to bite you at tax time.

The harm of withholding too much is opportunity cost. It may be nice to get a tax refund every year, but a tax refund is your money. Anytime you get a large tax refund, you voluntarily gave the government an interest-free loan for up to 18 months. Trust me, the government has plenty of ways to get money, and it doesn’t need interest-free cash from you.

Too little withholding can also be annoying. If you set your withholding to zero and are in a high tax bracket, you could easily see a five-figure bill come April 15. Do you want to be the one to break it to your spouse that you can’t put a pool in this year because you owe Uncle Sam $22,485.37? Oh, and if you try to withhold $0 every year for no reason, the IRS will eventually ask questions.

Figuring out and actually getting the right withholding number is complicated. But it’s worth it if you don’t want to be sweating bullets on tax day. Here’s what you should do.

How much should you withhold for taxes? The IRS has a convenient web app that you can use. 100% chance that’s the first time that sentence has ever been typed. Visit the IRS Tax Withholding Estimator, and you can determine the best amount to withhold.

Let’s say you’re a single person making $120,000/year with no dependents. You contribute 5% to a 401(k) and expect a $15,000 bonus at the end of the year. Assuming you have no other adjustments or deductions, the calculator predicts you’ll owe $21,686 in taxes when you file, if you withhold nothing. Goodbye swimming pool.

In order to set your refund to $0, the IRS recommends withholding $696 per pay period (every two weeks in this instance). It even has a slider to set a withholding amount if you want to get a refund. So if you’re thinking about getting into lending in the future, this could be an ideal way to get some experience. You can even write a post on LinkedIn about the federal government being one of your customers.

Finding state withholding tax is a little more involved. Some states have no income tax. Some states do and have their own version of the calculator. For example, Utah, where I live, has a 4.95% annual income tax rate and an Income Tax Estimator on the treasury’s website.

You fill out a W-4 when you start employment, but you can make changes later with a quick email to HR. HR will either send you the form, or you can send it to them. The HR rep will likely hesitate to give direct advice on what you should put, so you’ll need to fill it out yourself.

The W-4 is confusing. Any government form that requires multiple pages of explanations to answer three questions will be. Luckily, we can use the calculator to make it a little easier.

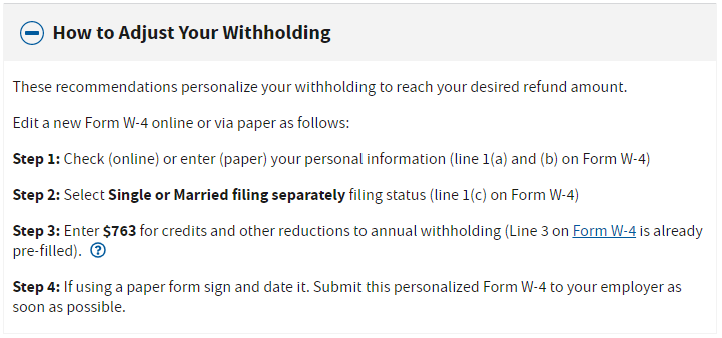

At the end of the calculator process, expand the “How to Adjust Your Withholding Amount” box and click on the Form W-4 link in Step 3. This will open a W-4 with the correct number in additional withholding already entered. You just need to fill out the personal info. This number isn’t the same as the $696 per pay period because it is reduced by the standard withholding amount. It is the extra amount you should withhold for taxes.

The final step is to file your taxes. If you only have a W-2, you can likely do it online on your own. Anything more complicated than that, and you should probably get help from your local CPA or the guy in a kiosk at Walmart.

The key here is to pay attention to how much tax you end up owing (or getting refunded). Remember, if you get a refund, you’re lending the government money that you could invest (or spend on big TVs to watch football).

If you’re surprised by the amount in either direction, it could be because of side income, unexpected bonuses, or entry errors from your company’s HR department. Return to the IRS calculator above, determine how much you want to withhold, and send in the new W-4.

ZIRP, or Zero Interest Rate Policy, is a central bank policy used to stimulate growth in the economy by reducing short-term interest rates to 0%. Don’t stimulate growth in the government by giving it a 0% short-term loan. Calculate the ideal withholding amount, fill out your W-4, and follow up when you file taxes.

We can help. Read more of Smart MNE’s New You Guide, a collection of tips and explainers to start your new job, internship, or whatever on the right foot.