Did you know that investing in classic cars can be a smart long-term move? But before you drive off into the sunset, hit the brakes.

Did you know that investing in classic cars can be a smart long-term move? But before you drive off into the sunset, hit the brakes.

Remember the poster of a classic Porsche 911 that hung on your wall in high school? It may be time to revisit that fantasy. Vintage and collectible cars can be smart investments that appreciate in value.

But before you drive off into the sunset with your profits, hit the brakes. To make a good purchase, devote time to researching the classic car market. If you don’t, you risk leaving your hard-earned money in the dust.

In today’s roller-coaster economy, investors are looking for safe havens. The stock market is careering daily and real-estate prices are at record highs. Classic cars are intriguing. They’re hard assets that can appreciate, and more investors are climbing in. The global classic car market is expected to grow to nearly $43.4 billion by 2024, per Statista—a more than 40% increase from 2020. One reason, according to classic car analytics firm Hagerty, is that millennials and Gen Zers are starting to get interested in collectible cars, driving up demand.

The majority of classic car transactions are private sales—as much as 90%, according to Hagerty—which makes it difficult to track the market. However, online auctions are becoming more popular, creating more transparency in pricing and making it easier for aspiring collectors to get involved.

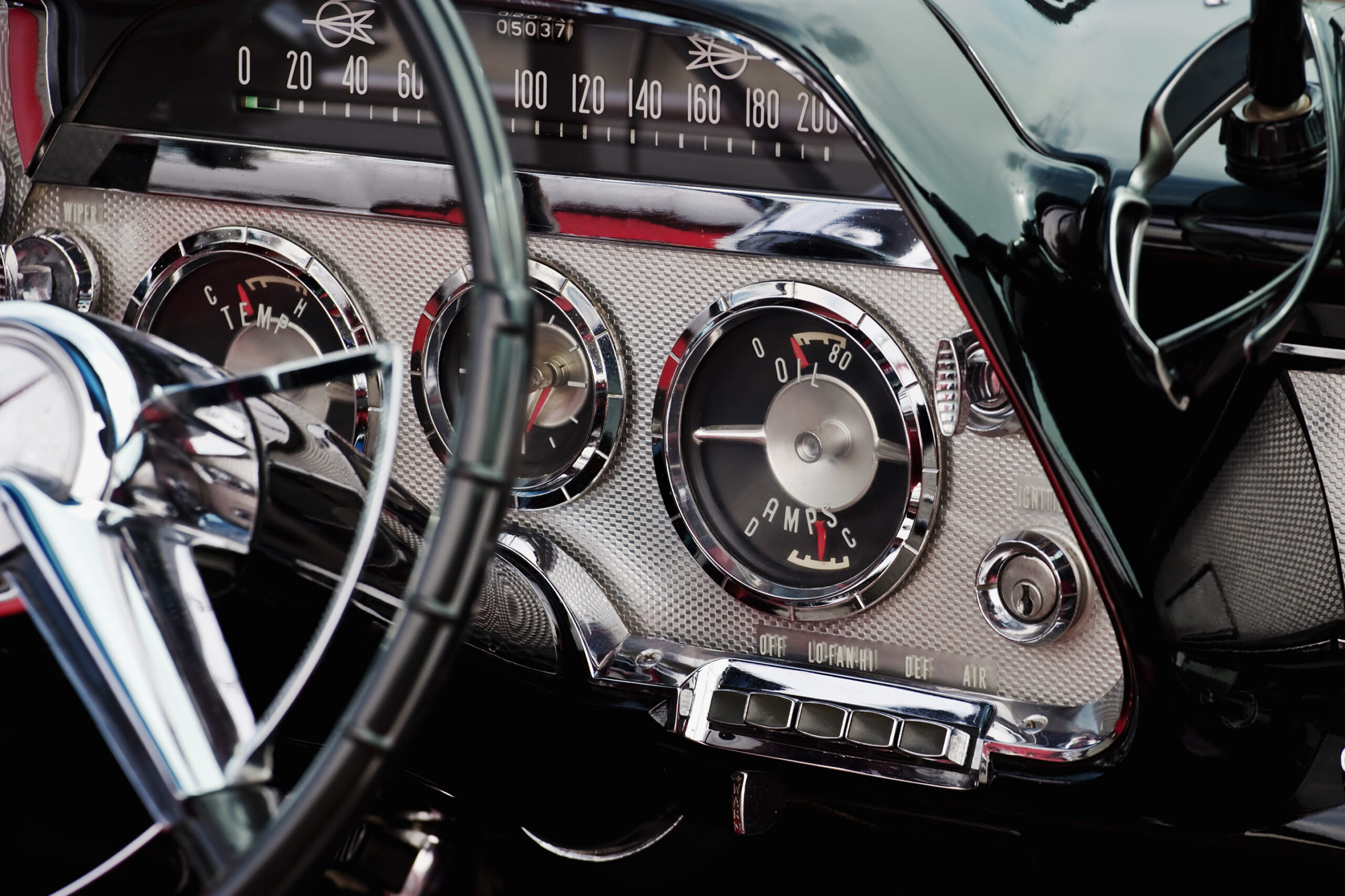

A classic car isn’t just any beautiful or expensive car. As a rule of thumb, the fewer models of a particular vehicle that’s produced, the higher their value will be. Other factors to consider include maker, condition, mileage, quality of restoration, and parts.

Classic vehicles often have an unusual attribute or hook. A car could have been part of a limited production or built with unusual specifications or luxe interior design. Sometimes, cars command high prices because of who drove them or where they’ve been. For instance, a 1967 Ford Mustang driven by Nicholas Cage in the movie “Gone in Sixty Seconds” sold for $852,500.

Well-preserved, high-end sports cars, including makers like Ferrari, Porsche, and Maserati, can be worthy investments. According to recent listings on Hagerty’s website, a rare 1962 Porsche Twin Grill Roadster S90 (T6) is going for $539,000, while a 1982 Ferrari GTSI is priced at $125,000.

Vintage models from the 1930s, 40s, or 50s that have been lovingly restored and carefully kept can command top dollar, such as a 1933 MG listed for $65,000. These models are valuable because of supply and demand: There are more people who want them than models that are still drivable.

According to Hagerty, Japanese cars from the 1980s have been popular, including the 1988-91 Honda Prelude or 1983-89 Mitsubishi Starion. Recent model year pickups are also red-hot, including the 1992-97 Ford F Series, which recently jumped 98% in value to $28,268.

The best classic cars to invest in change all the time, so experts suggest would-be collectors study up. Start tracking auction prices, read online classifieds and buyer’s guides, and attend classic car shows.

If classic cars sound more interesting than buying bonds, read on. Shopping for a classic car is an exciting process and ends with a beautiful vehicle you can enjoy driving and watch appreciate in value.

When buying a brand new car from a dealer, it starts to decline in value the minute you drive off the lot. That’s not the case with classic cars. The value of an older, sought-after classic car actually increases over time. Of course, you need to make sure it’s cared for and maintained (not like that poor excuse for a houseplant in your living room). If you do, the value should go up and up.

If you make a smart buy and maintain your collectible, you can make bank when you sell it. According to Hagerty, classic cars are getting more valuable as young, enthusiastic buyers with disposable income enter the market. When you have a hot car and price it right, you could double your investment or more.

Much like fine art, the classic car world is full of deep-pocketed collectors. That doesn’t mean you can’t play their game. The market for art and classic cars have similarities. Value is often based on aesthetics and quality—the finer the “work,” the higher the prices. A gorgeous painting or rare car can defy current economic conditions too, as their value transcends the highs and lows of the stock market or earnings reports.

Also, like art, classic cars can be a way to take advantage of exchange rates, too. When the dollar is strong, as it is now, you may find favorable deals on cars in Europe or even Canada. You can also display these assets and move them to new locations to find potential buyers.

When you buy a classic car, you’re also getting an asset you can enjoy. Think of it like a beach house or ski condo that you buy as an investment property to rent but visit occasionally too. You can use your classic car daily, take it on road trips, or show it off at a car show.

Owning a car as an investment is a diversification strategy. The car market isn’t correlated to the bond or stock market, so it’s a good way to keep your entire investment portfolio from tanking if there’s a financial downturn.

Classic cars are not for the faint of heart. Yes, they’re beautiful and exciting, but they’re also expensive and demanding (sounds a bit like your ex, right?). So, before you raise your paddle at an auction, consider the downsides of classic cars.

You probably won’t find too many deals in the classic car market. Cheap cars mean problems. If you’re buying a good classic car, you need to have funds at the ready. Most dealers and private sales will want cash or a check. You won’t find financing opportunities like you would with a new car dealer or even from your bank or credit union.

Even if you don’t drive your classic car, you’ll still need to register and insure it. Typically, it costs less to buy coverage for classic cars than your regular vehicle, but talk to a licensed insurance broker. Finally, if you buy a classic car at an auction, expect to pay fees to the auction house for the transaction and, if applicable, delivery.

Vintage and classic cars can be finicky. They need special parts and skilled technicians. When purchasing a classic car, consider the upkeep costs, including parts, restoration, and tune-ups. It can be challenging to find a qualified mechanic to work on the car.

Also, you can’t just park your pricey ride on any side street or leave it in your parent’s driveway in New Jersey. Classic cars need to be protected from the elements, including sun, snow, sand, and salt. Experts recommend storing them covered and in climate-controlled areas. Finally, if you don’t plan to drive it from the sale site, you’ll need to arrange for transportation. All of that requires planning and extra cash.

A word of caution: Before you buy a classic car, make sure you test drive it and have a well-respected mechanic give it a good examination.

We don’t have to explain Econ 101 to investment bankers, but it’s always good to review the basics: With any commodity, when there is intense demand and limited supply, prices go up. That could be for $25 custom salads (we know, we love Sweetgreen too) or a 500 square-foot studio that costs $4,000 a month. But when interest plummets, prices drop.

The same rules apply to classic cars. The value is dictated by demand in the market. You may do all your homework and decide on an investment-worthy car, but then go to sell and find no buyers. Given that uncertainty and the costs of maintaining classic cars, be sure you can afford to hold and maintain your asset until you find a buyer with a good offer.

There’s no such thing as free money. When you do sell your classic car, you will need to pay taxes on it. Luckily, the proceeds on a car sale are treated as capital gains, which is typically taxed lower than your other income. When you’re considering offers to sell your car, build that tax nut into your equation. And, before you ask, yes, you can sell privately and avoid taxes, but we don’t recommend that.

If you have money to spare and interest in the auto industry, classic cars could be a good idea, particularly as a long-term investment. But like any investment, do your homework—and be prepared to care for your car as if it were part of the family.