This sounds like a low bar, but you might actually be able to snag a 2019 Dodge Caravan for less than $25,000 if the used car market holds steady.

This sounds like a low bar, but you might actually be able to snag a 2019 Dodge Caravan for less than $25,000 if the used car market holds steady.

This sounds like a low bar, but you might actually be able to snag a 2019 Dodge Caravan for less than $25,000 if the used car market holds steady.

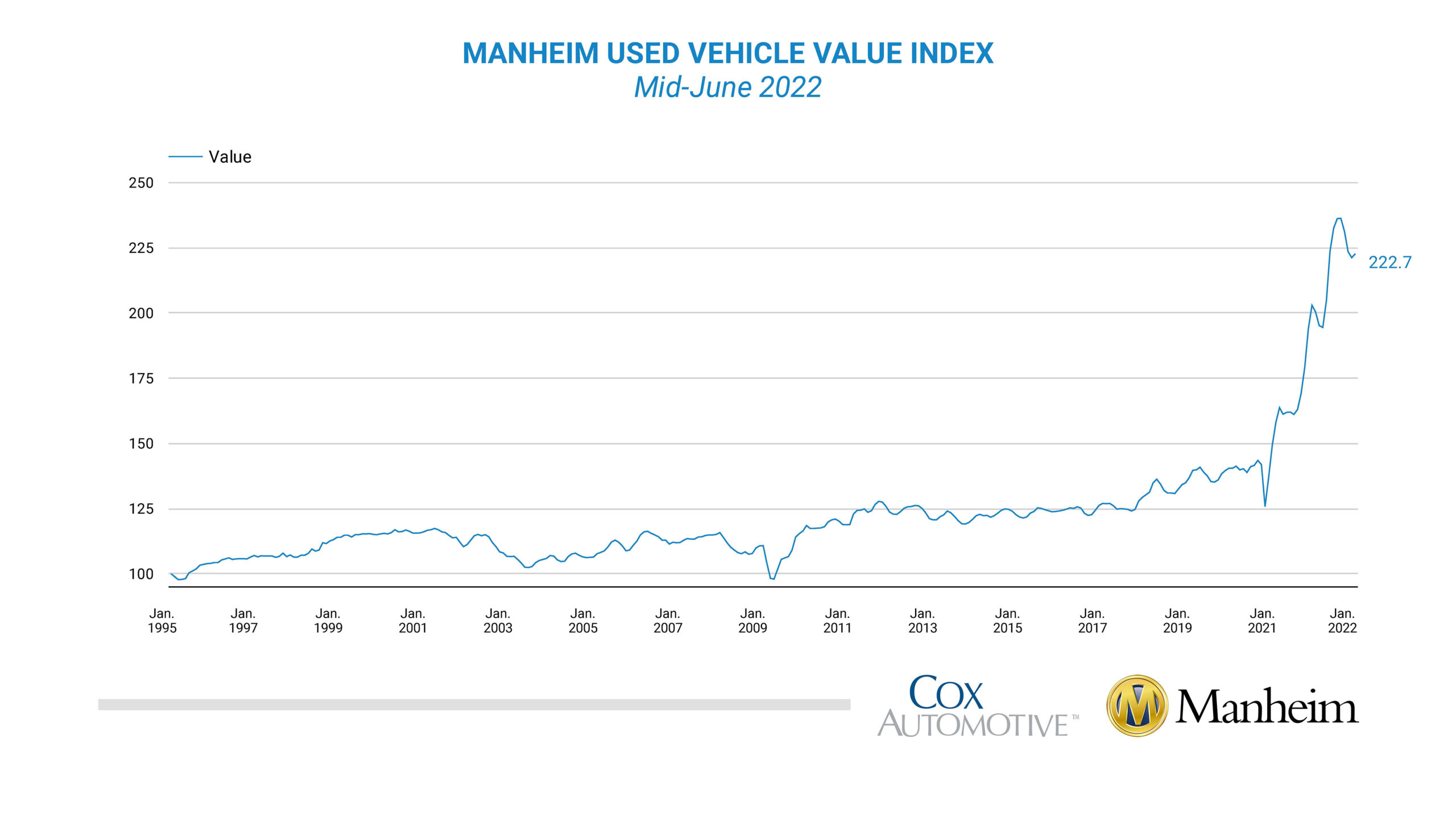

The used vehicle value index by Manheim and Cox Automotive didn’t change between the end of May and June 15, which comes as a relief to used car shoppers who’ve been paying above top dollar to drive a car that someone may or may not have puked in at some point. The report, released Friday, said that used-car prices are expected to decline in the second half of June.

Jonathan Smoke, the chief economist at Cox Automotive, said in a tweet that “trends reflect normal price depreciation,” adding that it’s “a signal that demand and supply are in balance.”

Prices for used vehicles are still up 11.1% year over year on a mixed-, mileage-, and seasonally adjusted basis. Prices for most types of vehicles—including SUVs, full-sized cars, and compact cars—are still higher now than they were a year ago, except those for pickup trucks, which have declined by 1.2%. Vans prices led the year-over-year increase at 24.8% on a seasonally adjusted basis.

What could be driving (ha) the cooling used car market: Consumer sentiment is down, which tends to tamp demand. Used-car inventory constraints are easing, with the average wholesale supply lasting 25 days, compared to just 20 days year over year.

Over the past two years, Car shoppers have been faced with a painful lack of inventory due to chip shortages, which are also showing signs of easing. With more chips, manufacturers can sell more new cars, easing used-car demand and prices.