We hoped inflation had already peaked, like all the popular kids in high school. But we were wrong.

We hoped inflation had already peaked, like all the popular kids in high school. But we were wrong.

Like all the popular kids in high school, we hoped inflation had already peaked. But we were wrong, just like you were wrong about high-school quarterback Russell, who’s outearning you by 3x.

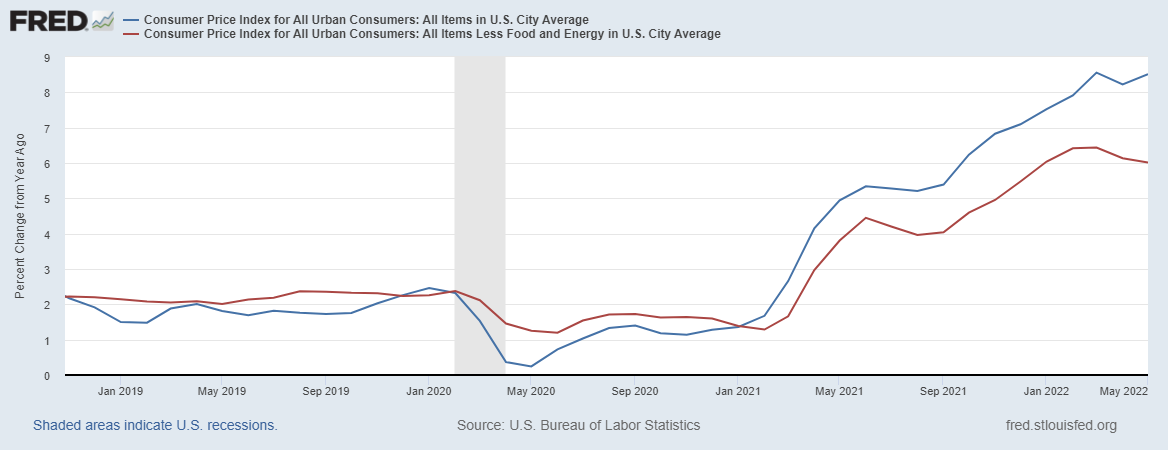

Top-line inflation reached 8.6% annually in May, up 1% since April to be the highest annual inflation rate since 1981. When you strip out food and energy prices—two of the most significant contributors to inflation growth—core inflation is running at an even 6%, up 0.6% over April. Both rates came in above economist expectations—and this isn’t the type of report card where you want to exceed expectations. The data comes from today’s Consumer Price Index (CPI) report from the U.S. Bureau of Labor Statistics.

Oil prices, food, and shelter played major roles in this month’s CPI reading. On a seasonally adjusted basis, unless otherwise noted:

The yield curve flattened on the whack inflation news as investors expect the Federal Reserve to continue its interest rate hikes, which are supposed to tamp inflation growth.

The yield curve is flattening because the Fed is likely to stay on track to tighten aggressively. pic.twitter.com/SYeVymNuAj

— Kathy Jones (@KathyJones) June 10, 2022