Now more than ever, asset class diversification is vital.

Now more than ever, asset class diversification is vital.

Many of us entered the first true* bear market of our money-earning lives this week. With the S&P 500 down more than 20% since its January peak, we’re looking at what could be many more months of punishing trading days.

If history is any guide (it’s not), we won’t see the bottom until October with the S&P around 3,000 (it closed at 3,673 on Friday), per a Bank of America report. And Fidelity Director of Global Macro Jurrien Timmer said what he’s seeing is “not the stuff bull markets are made of,” citing compressing P/E ratios and slower earnings growth.

We’ve started investing during one of the most iconic bull runs in history. It was easy to make money if you bet it all on tech, bitcoin, or Tom Brady. With tech stocks sputtering and bitcoin (and crypto) cratering, I guess that leaves Tom Brady as our only hope for wins.

But the point of a bear market isn’t to win; it’s to make it to the other side. Here are some tips to buoy your portfolio in a bear market.

You know to eat a well-balanced diet, but that doesn’t stop you from ordering Pizza Hut every time you’re awake at 3 a.m. If you’re doing the same with your investments—knowing you should diversify but invest too heavily in high-growth tech stocks or real estate—then you’re getting your comeuppance right now.

Ok, but: Just because your stocks are down doesn’t mean you have a good reason to sell. Your thesis for buying those assets hasn’t necessarily been disproven. In general, the best investment plan is to stay the course. But if you just can’t cope with a hemorrhaging portfolio, you can consider scaling back some of your more aggressive investments.

Now more than ever, asset class diversification is vital. Tech comprises more than a quarter of the S&P 500 index, so even if you’re investing in a broad-market index fund (which is excellent!), there’s still more room for you to diversify. Look into other assets—bonds, real estate, Birkins—to keep your investments steadier during rocky times.

… Consider the benefits of tax-loss harvesting. CFP and Smart MNE writer Austin Delery gets into that later in the newsletter.

You’ve heard of dollar-cost averaging, where you invest at regular intervals rather than in giant chunks. Keep doing that by making your typical weekly, semi-monthly, or monthly investments and 401(k) contributions; through it all, you’re getting a major discount on your investments compared to where they were in January, and you’re avoiding getting into the market at the wrong time.

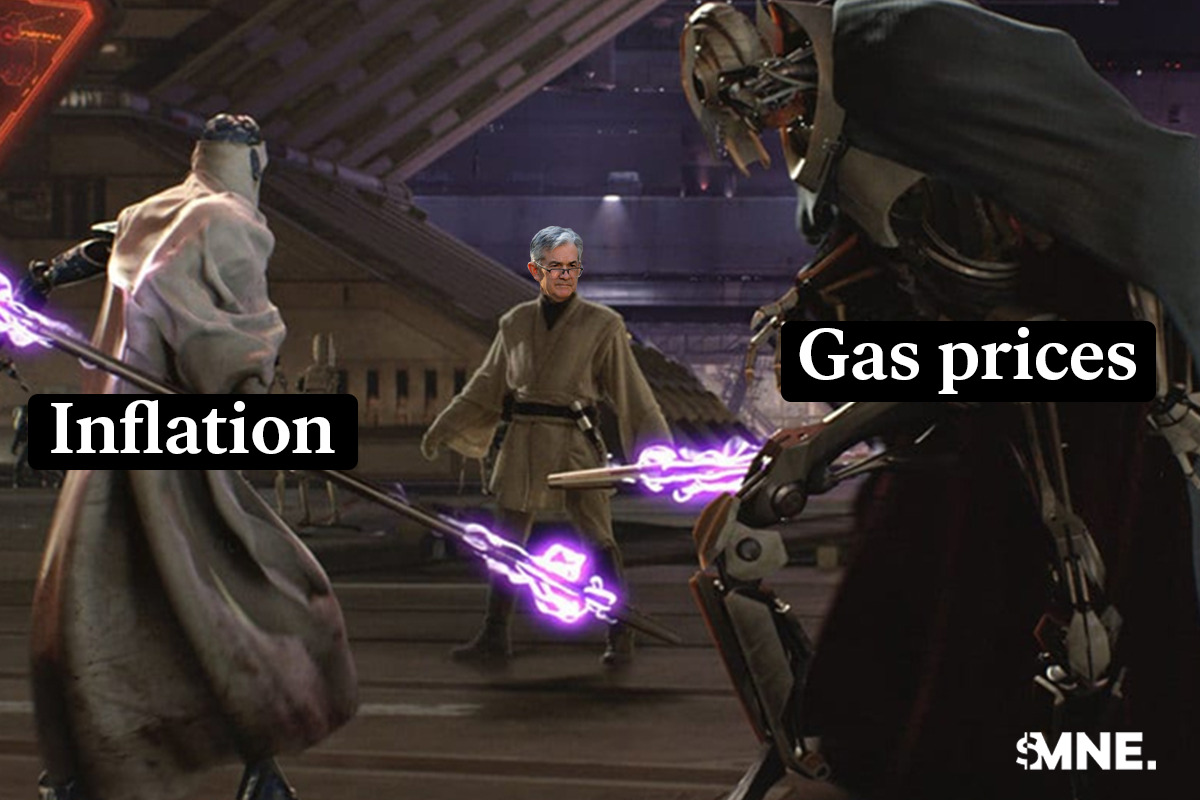

But be warned: Not only are we in a bear market, we’re also eyeing a recession. While Fed Chair Jerome Powell remains optimistic about bringing down inflation without causing a recession or large-scale unemployment, experts are sus. So it’ll be a good idea to make sure you have enough cash on the side to ride out any bad times.

Studies show that you’re more likely to F up your investments if you’re watching them too closely. And market data proves that: Fidelity research found that investors who’ve tried to time the market are more likely to miss out on the market’s best days, winding up with way less money in the long run.

*We entered an itsy-bitsy teenie-weenie bear market in March 2020. But that’s not the same.